During his life and career spanning the ranches of Laredo, Texas, to the corridors of Washington, D.C., and the boardrooms of global businesses, Ed Knight ’76 has witnessed incredible global technological and economic change.

At Nasdaq Inc., best known for the all-electronic stock market that bears its name, Knight spent 20 years as global chief legal and policy officer. In that role, he oversaw legal matters across the company and was accountable for the regulatory responsibilities of over 20 markets in the U.S. and Europe.

Four years ago, Knight became Nasdaq’s executive vice chairman, stepping back from the legal arena to lead its global government relations program. Knight also represents Nasdaq as a member of the boards of the World Federation of Exchanges and of Nasdaq Dubai. He additionally serves as chairperson for both the U.S.-India Business Council and TechNet, a technology company trade association.

We recently spoke to Knight about what he’s learned from a career in politics, global financial systems, and working with entrepreneurs.

For our readers who might not know, what exactly is Nasdaq?

At Nasdaq our vision is to become the trusted fabric of the financial system. Many people know us for our exchanges, which we own and operate in the U.S. and Northern Europe. Our business has evolved in recent years, and now we are a truly global technology company that serves the broader financial system. Our marketplace technology offerings power exchanges and markets around the world from Singapore and Colombia to Switzerland and Kuwait. We provide anti-financial crime and market surveillance technology that upholds the integrity of the capital markets and protects consumers from those who seek to abuse the financial system for their own gain.

Going back to a time before your work at Nasdaq, what was your first job after Texas Law?

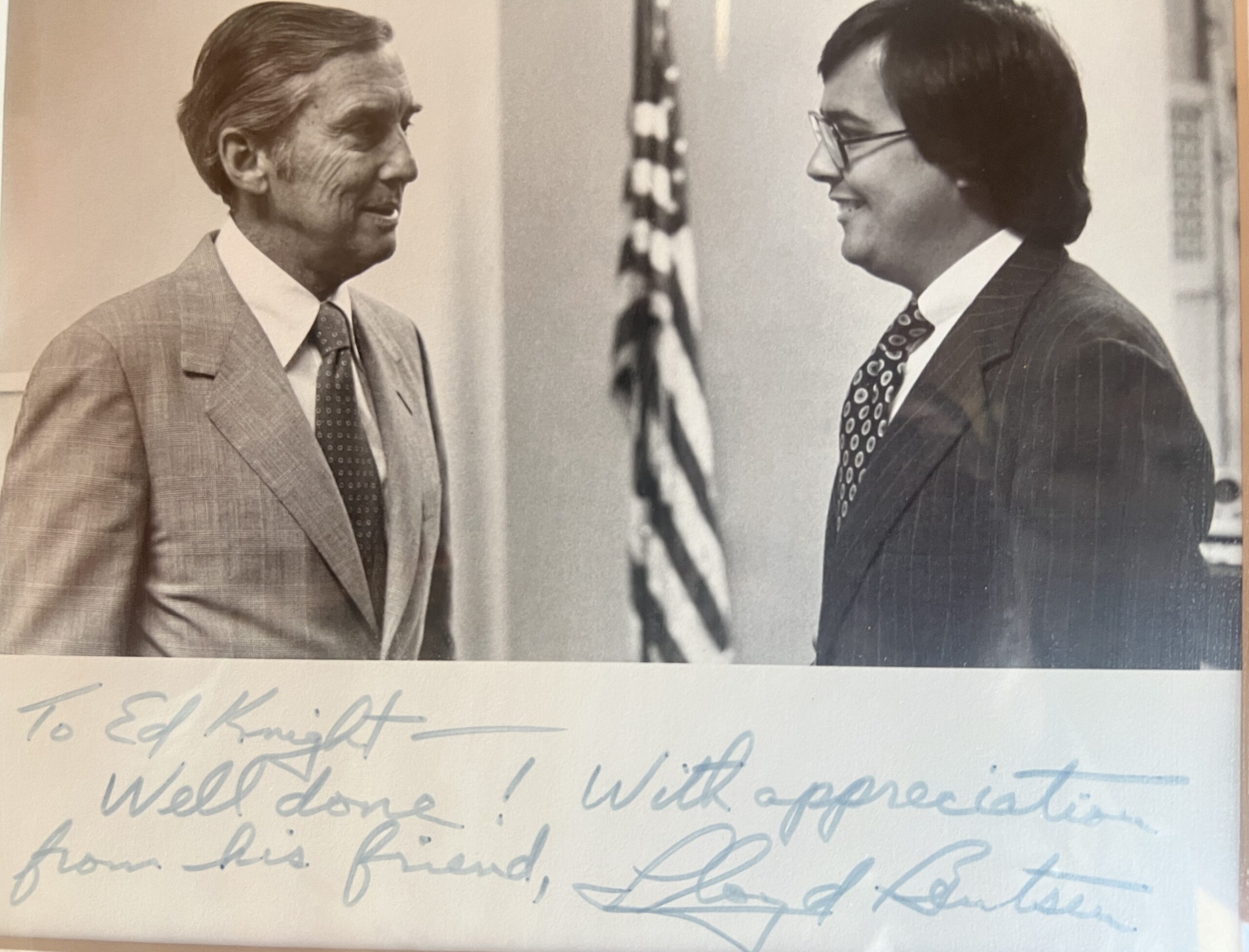

I was fortunate to start my career right out of law school as a legislative assistant to Sen. Lloyd Bentsen. It was a bit overwhelming going from sitting in a classroom to a few months later sitting on the Senate floor. One of my first assignments was the natural gas deregulation legislation that passed the Senate after a 14-day filibuster on the Senate floor.

During that debate, I got to know some of the lawyers at Akin Gump. They offered me a job. I ended up spending 14 years in the firm’s Washington office, eventually becoming a partner. However, I never lost touch with Sen. Bentsen. He was a kind and generous mentor to me throughout my career.

In 1988 Sen. Bentsen asked me to help as a senior advisor when he ran for vice president with Gov. Michael Dukakis on the Democratic ticket. We went to 141 cities in 39 days. I wrote speeches and learned I had some higher gears in my engine than I thought I had.

We lost the election but four years later Bill Clinton asked Sen. Bentsen to be his first treasury secretary. Secretary Bentsen asked me to be executive secretary of the department and then the general counsel. I was at Treasury for most of President Clinton’s two terms during a time of global integration and far-reaching economic change.

The American legal system is the finest in the world. Deeply understanding this system, as the University of Texas School of Law prepares you to do, will equip you to fulfill your dreams.

Ed Knight

Let’s go back even further: Where are you from originally, and how did you end up at UT with an honors degree in Latin American studies and then law school?

My mother is Hispanic—she grew up in Laredo, Texas, in a ranching family. I was exposed to the Hispanic culture from an early age when I spent my summers with my grandmother in Laredo and at the ranch. My wife, Amy, grew up in Connecticut and spent her summers in Nantucket. I still prefer Laredo! I love South Texas—a unique place, neither fully Texas nor Mexico, but a blend of both cultures.

I became fascinated with Latin American history and culture. UT’s School of Latin American Studies is one of the best in the country, and I was drawn to it. That study and interest served me well while I was at Treasury and now at Nasdaq.

How has your own perspective shaped your priorities and commitments at Nasdaq?

I don’t want to oversimplify but, particularly, while serving in government but also here at Nasdaq, I try to “really show up,” as one wise man told me. This means I try to be prepared, do my very best, and realize the opportunity this day presents is not coming again. I had the opportunity to deal with the Mexican financial crisis in 1995, the Asian financial crisis, NAFTA, and multiple trade agreements at Treasury. It was full immersion in the global economy. Barriers between trade and commerce were coming down and as that happened the U.S. economy expanded—the Clinton era remains the longest period of sustained economic growth in our history. I like to say, “What is it that you did not like about the Clinton presidency: the peace or the prosperity?”

The push for global integration is taking a different form now—aligning across regions and low-risk supply chains—but the world is still a small place with many interconnections. I have always been very curious about witnessing cross-border diplomacy and commerce up close. Nasdaq has given me more opportunities to explore this interest in the world at large. The sun never sets on Nasdaq’s business.

As part of your longtime commitment to Texas Law, you’ve served on the Law School Foundation Board in a leadership position, and you’ve endowed a chair: The Edward S. Knight Chair in Law, Entrepreneurialism, and Innovation, currently held by Prof. John Golden, one of the nation’s foremost scholars in intellectual property, patents, and the intersection of science, technology, and the law. Where does your passion for entrepreneurship come from?

At Nasdaq, you get to see leading entrepreneurs up close and personal. They are special people and the U.S. culture, education system, and work ethic produce some of the best. They have vision and energy. And that vision is usually about making a better world and improving the human condition, whether it is though new bio pharmaceuticals or a new chip design. We need to encourage this and continue to nurture the culture of innovation in our country.

The legal profession needs to rise to the occasion. It’s important for laws to evolve over time to deal with new technology—not to control it per se but to guide it and continue to preserve the U.S. as a place where entrepreneurs can experiment and compete.

Given your global vantagepoint, what do you believe people need to know?

From an economic perspective, we need to understand that the U.S. economy cannot achieve sustained growth without either Asia, Europe, or both growing at the same time. The economic activity in our economy alone will not give us the jobs and rising quality of life we want and need.

U.S. national security concerns and supply chain risks have given us a new prism to view global economic integration. We are still figuring out how to best work with the rest of the world. It is definitely a more complicated place to navigate.

I still believe in Pres. John F. Kennedy’s words spoken at American University in June 1963:

“For, in the final analysis, our most basic common link is that we all inhabit this small planet. We all breathe the same air. We all cherish our children’s future. And we are all mortal.”

Finally, what’s your advice for today’s law students?

The American legal system is the finest in the world. It underpins our markets and economy—it is a foundation to our national security. Deeply understanding this system, as the University of Texas Law School prepares you to understand it, will equip you to fulfill your dreams.

The journey does not end with law school. It continues throughout your life and is fed by perseverance and hard work.

Thanks so much for taking all this time. We really appreciate it.